Bitcoin's Perfect Storm 2025: Why Bitcoin Is About to Explode Beyond All Imagination

The Trinity of Convergence is here: three hidden forces are creating the greatest wealth creation opportunity of the century. Analysis of the true drivers of Bitcoin towards unthinkable targets

IMMAGINE

DISCLAIMER: The opinions expressed in this article represent solely a personal analysis and do not constitute financial advice. For the complete disclaimer, please refer to the legal notice at the end of the article.

English Version Note: 👋 Hello English-speaking friends!

This article has been translated from Italian using an advanced AI translator. While i've done my best to ensure accuracy, you might occasionally notice some "lost in translation" moments or technical terms that sound a bit off. Think of it as the charming Italian accent of the text! 😊 The core insights and analysis remain intact, even if a phrase here or there might read a bit differently than a native English writer would express it.

Prologue: The Calm Before the Storm

There's that fraction of a second, before a rogue wave hits, when the ocean becomes strangely calm. The air becomes dense. Birds stop singing. It's the moment that precedes the inevitable.

We're living through that moment now, and most people don't even notice.

After years spent studying Bitcoin, I've learned to recognize the patterns that precede epochal changes. I missed the first halving of 2012, when Bitcoin was worth $12 and seemed like a nerd experiment. I witnessed the explosion of 2017, when ICOs drove the world crazy. I went through the crash of 2018, when Bitcoin fell from $20,000 to $3,200 and everyone said it was dead.

But what I'm seeing now is different. It's not just another Bitcoin cycle. It's the convergence of three titanic forces that, for the first time in history, are aligning simultaneously:

The Trinity of Convergence:

The explosion of global liquidity (M2 breakout after 5 years)

The corporate weaponization of Bitcoin (from 0 to $100B+ in 18 months)

The sovereign race for strategic reserves (from 2 to 15+ nations)

This is not speculation. It's data. Patterns. Applied mathematics.

And what emerges from this analysis gives me chills for the implication: we could be facing the most significant moment in modern monetary history.

The Trinity of Convergence: An Unrepeatable Phenomenon

What makes this convergence so extraordinary are not the individual forces - we've seen expansive liquidity before, we've seen corporate adoption, we've seen government interest. It's the simultaneity.

For the first time in Bitcoin's history, these three titanic forces are all manifesting together, at the same moment, amplifying each other in ways we've never seen.

PART I: The Global Liquidity Explosion - The Storm's Fuel

The Signal That Appears Only Once Per Cycle

Let's forget for a moment about prices, tweets, sentiment. What really matters is liquidity - and more specifically, global M2, the money flowing through the arteries of the world economy.

US M2 reached $21.86 trillion in April 2025, but it's global M2 - which includes the four major central banks of the world (Fed, ECB, BoJ, PBoC) - that tells the real story.

And this story is crystal clear: when global M2 breaks from consolidation and explodes upward, Bitcoin follows with a lag of about 12 weeks.

It's not random correlation. It's monetary physics. More money in the system means more capital seeking returns, and Bitcoin has become the most powerful magnet for this excess capital.

The Numbers That Never Lie

Let's step back and look at historical data, because the patterns are unmistakable:

2013 CYCLE:

Bottom: $13 → Top: $1,100

Multiple: 85x

Driver: Early retail, no structured liquidity

2017 CYCLE:

Bottom: $200 → Top: $20,000

Multiple: 100x

Driver: ICO mania + first institutionals

2021 CYCLE:

Bottom: $3,100 → Top: $69,000

Multiple: 22x

Driver: COVID stimulus + first corporate treasury

2025 CYCLE:

Bottom: $16,000 → Top: ?

Projected Multiple: 8x-20x

Driver: THE TRINITY OF CONVERGENCE

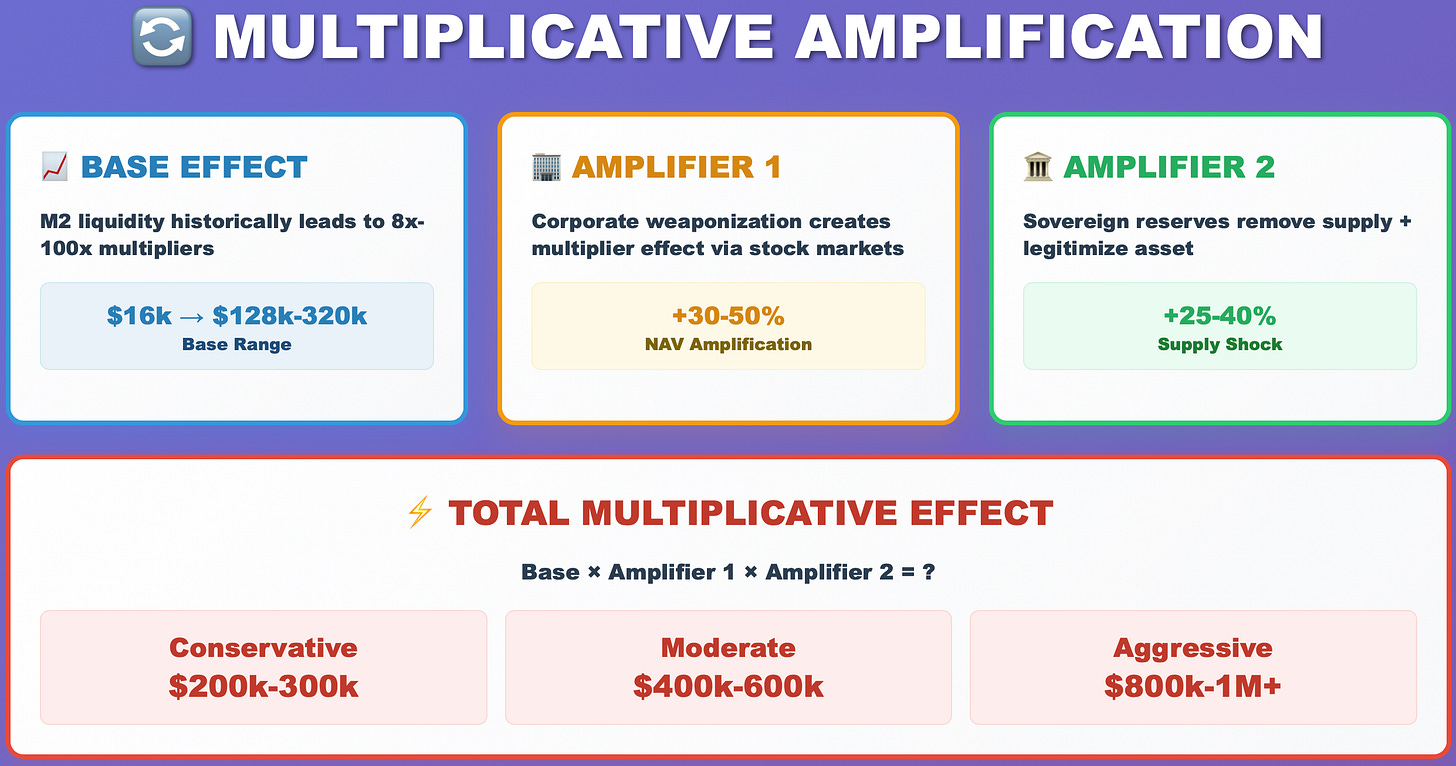

If we apply historical multipliers to the 2022 bottom:

But these calculations assume conditions similar to previous cycles. And here's the point: conditions aren't similar at all. They're radically different, and potentially much more explosive.

The Mechanics of Liquidity: How Money Becomes Bitcoin

To truly understand what's happening, we need to get into the mechanics of how liquidity transforms into Bitcoin demand.

PHASE 1: LIQUIDITY CREATION Central banks expand M2 through:

Quantitative Easing (massive bond purchases)

Interest rate reduction

Direct stimulus programs

PHASE 2: YIELD SEARCH Excess liquidity seeks:

Assets with growth superior to inflation

Alternative stores of value to cash

Protection from fiat devaluation

PHASE 3: BITCOIN ALLOCATION Capital flows toward Bitcoin for:

Programmed scarcity (21M cap)

Superior historical performance

Anti-devaluation narrative

Growing accessibility (ETF, corporate treasury)

The Lag Effect: Why 12 Weeks Are Crucial

One of the most fascinating aspects of this pattern is the consistency of the time lag. Bitcoin tends to respond to global M2 expansion with a delay of about 12 weeks.

This isn't random. It reflects the time needed for:

Institutional digestion (4-6 weeks): Funds analyze new liquidity flows

Strategic allocation (2-4 weeks): They decide how to reallocate portfolios

Operational execution (2-4 weeks): They actually implement the purchases

Knowing this, we can look at global M2 expansion as a leading indicator for Bitcoin. And what we see now is an M2 breakout that has just begun.

Current Numbers: We're Only at the Beginning

Global M2 growth year-over-year is entering expansive territory, but we're literally in the first weeks of this breakout.

If history is a guide, this means the "Bitcoin response" phase hasn't fully started yet. We're in the lag period.

But there's a crucial difference from previous cycles: this time, liquidity isn't entering an empty Bitcoin market. It's entering a market where two other titanic forces are already operating simultaneously.

PART II: Corporate Weaponization - When Wall Street Becomes Bitcoin Street

The Silent Invasion That Changed Everything

While everyone was watching ETFs in 2024, something much more significant was happening in the shadows. Companies weren't just buying Bitcoin - they were weaponizing capital markets to accumulate it on an industrial scale.

The numbers are staggering:

In 2024, the number of BTC in corporate treasuries grew by 31%, reaching 998,374 BTC according to BitcoinTreasuries. But it's 2025 that has seen the impossible-to-ignore acceleration.

In the first months of 2025, corporate accumulation has seen a dramatic surge:

Public companies now hold at least 819,689 BTC (3.9% of Bitcoin's total supply)

Private companies control another 292,047 BTC

The corporate total has reached about 1.11 million BTC (5.29% of all existing Bitcoin)

This means that from 2024 to 2025, corporate treasuries have added over 112,000 Bitcoin - a growth of +11.2% in a few months.

In just the month until June 11, 2025, at least 22 new entities have added Bitcoin as a reserve asset, according to BitcoinTreasuries.net.

We're not talking about companies buying Bitcoin with excess cash. We're talking about companies issuing billions in convertible bonds, raising capital specifically to buy Bitcoin, and restructuring entire business models around accumulation.

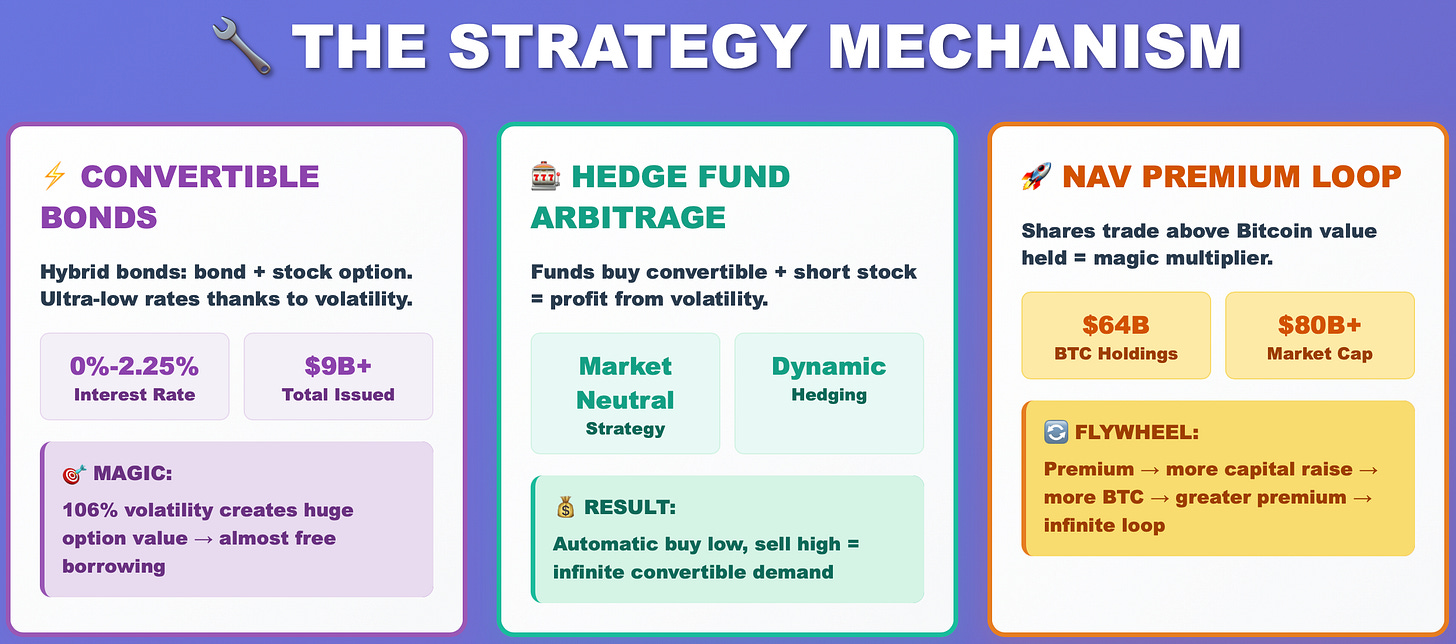

The MicroStrategy Model: The Blueprint That Changed the Rules

To understand this revolution, we need to start with its architect: Michael Saylor and his strategy with MicroStrategy (now Strategy).

🔎 You can find an in-depth analysis in my previous article:

LA GRANDE ILLUSIONE DI STRATEGY: COME IL PIÙ GRANDE ACQUIRENTE ISTITUZIONALE DI BITCOIN NASCONDE LA SUA VERA REALTÀ FINANZIARIA

Strategy holds 580,250 BTC worth about $64 billion, but the real genius isn't in the accumulation - it's in the mechanism.

The Science of Convertible Bonds: The $9 Billion Trick

The real genius of the Strategy model lies in convertible bonds. Strategy has issued convertible bonds for over $9 billion, with rates ranging from 0% to 2.25%.

How is it possible to borrow practically for free in an environment where Fed rates are at 5%?

The Answer: Implied Volatility

Strategy has a 30-day implied volatility of 102.30%, meaning investors expect the stock to change by 6.5% per day.

This monstrous volatility creates such a high value for the embedded call option in the convertible that investors are willing to lend money practically for free in exchange for the right to participate in the upside.

The Hedge Fund Ecosystem: The Machine That Never Sleeps

But who buys these convertible bonds? Mainly hedge funds doing convertible arbitrage:

Funds like Calamos Advisors LLC are buying billions of Strategy convertibles for market-neutral strategies that exploit volatility.

The mechanism is elegant:

Buy the convertible bond

Short Strategy shares

Hedge dynamically as the price moves

Profit from volatility without directional risk

This creates seemingly infinite demand for Strategy convertibles, which can continue to issue debt at ridiculously low rates to buy more Bitcoin.

The Multiplier Effect: When 1 Bitcoin Is Worth 10

Here's the part few understand: when Strategy buys Bitcoin, it's not just removing those Bitcoin from the market. It's creating a multiplier effect through the stock market.

Strategy has a significant NAV premium - its shares are worth more than the Bitcoin it owns. This means every dollar invested in Bitcoin by Strategy generates multiple dollars of stock market capitalization.

Practical example:

Strategy buys $1B of Bitcoin

The market values this increase at $1.3B in stock price

Strategy can issue $1.3B in shares to buy $1.3B of Bitcoin

It just transformed $1B into $1.3B of Bitcoin purchasing power

It's a positive feedback mechanism where buying Bitcoin feeds the ability to buy more Bitcoin.

The Model's Spread: The New Players

Strategy has now inspired an entire generation of imitators:

METAPLANET (Japan): 7,800 Bitcoin worth over $872 million, targeting 10,000 BTC by end of 2025. In less than a year it went from zombie company to 29th place by trading volume among 4,000 listed Japanese companies.

MARATHON DIGITAL: 48,237 BTC worth about $5.3 billion. Not only mines Bitcoin, but accumulates it as a treasury asset.

JETKING INFOTRAIN (India): First public company in India to adopt Bitcoin treasury. With only $2 million in annual revenue, it invested over $774,300 in Bitcoin.

KULR TECHNOLOGY: Completed the purchase of 217.18 Bitcoin for $21 million.

The Numbers Nobody Talks About

But here's the data that should make everyone think: Bernstein analysts predict that corporate treasuries will add $330 billion in Bitcoin by 2029.

These aren't optimistic forecasts from some Bitcoin maximalist. They're institutional analysts looking at capital flows and seeing an unstoppable trend.

The Strategy's Risk: When the Mechanism Jams

Of course, not everything is roses. Matthew Seagull of VanEck raised a crucial point: if Bitcoin treasury company shares start trading below Net Asset Value, every new issuance dilutes shareholders instead of creating value.

One company is already close to this dangerous level. If the trend spreads, we could see a reversal of this corporate strategy.

Coinbase CEO Brian Armstrong revealed that the company had considered allocating 80% of the balance sheet to Bitcoin but ultimately gave up, fearing it could "kill the company."

The New Convertible ETF: The Financialization of Financialization

As if it wasn't meta enough, REX Shares has launched the first ETF focused on convertible bonds of Bitcoin treasury companies: the REX Bitcoin Corporate Treasury Convertible Bond ETF (BMAX).

Now investors can buy an ETF that invests in convertible bonds of companies that use that money to buy Bitcoin. It's financialization to the nth power.

But this demonstrates one thing: the Strategy mechanism is no longer an eccentricity of a single visionary CEO. It has become a new asset class with its own financial instruments.

PART III: The Sovereign Race - When Nations Enter the Game

From Experiment to Geopolitical Tool

If corporate weaponization was the surprise of 2024, the sovereign race for Bitcoin strategic reserves is the earthquake of 2025.

Five years ago, only two countries - Oman and El Salvador - were mining Bitcoin at a government level. Today we're at 15+ countries, and the number is growing exponentially.

But we're not just talking about small nations experimenting. We're talking about a geopolitical revolution where Bitcoin is becoming a tool of monetary sovereignty.

The United States: The Definitive Game Changer

The turning point came on March 6, 2025, when President Trump signed the executive order to establish the Strategic Bitcoin Reserve.

The BitBonds: The Financial Revolution Nobody Sees Coming

The real innovation isn't just in the Strategic Bitcoin Reserve - it's in how they could expand it.

The Bitcoin Policy Institute has proposed "Bitcoin-Enhanced Treasury Bonds" (BitBonds) - a proposal to issue $2 trillion in bonds where 90% of proceeds go to normal government funding and 10% is used to buy Bitcoin.

The BitBonds Mechanics: BitBonds would pay a fixed rate of 1% annually (vs. 4.5% for normal Treasuries). In exchange for the lower rate, investors would get Bitcoin upside exposure with a sharing structure:

Investors get 100% of Bitcoin gains up to a compound return threshold

Above that threshold, 50-50 sharing between government and investors

Government keeps its share

The Numbers Are Staggering: Even if Bitcoin remained flat for 10 years, the US would save about $354 billion in present value after subtracting the $200 billion Bitcoin allocation from the $554.4 billion in interest rate savings.

If Bitcoin appreciates in line with historical medians, the program could offset significant portions of the national debt by 2035.

The Pakistan Case: Desperation, Innovation and Geopolitical Conflict

But the most fascinating story comes from Pakistan, which announced the allocation of 2,000 megawatts of electricity for Bitcoin mining and AI data centers.

It's not coincidence. It's geopolitical strategy.

Pakistan has an IMF loan that needs to be renewed. When the IMF says "you need to collect taxes on crypto," Pakistan doesn't just create a regulatory framework - it founds a Crypto Council, appoints CZ as advisor, and announces 2 gigawatts for mining.

The message is clear: "If you don't renew our loan, we might follow El Salvador and adopt Bitcoin as legal tender."

The IMF immediately asked for urgent clarifications, not having been consulted before the announcement. But Pakistan has created a precedent: Bitcoin as a sovereign negotiation tool.

The Domino Effect: When the Small Move the Big

Pakistan is ninth in Chainalysis's 2024 crypto adoption ranking, with over 27 million estimated crypto users by 2025 on a population of 247 million.

But the real pattern is seen looking at the complete list:

ETHIOPIA: 21 mining farms mainly Chinese have signed agreements with the government. Electricity at $3.14 cents per kWh thanks to the Grand Ethiopian Renaissance Dam.

KENYA: KenGen has publicly invited Bitcoin miners to use its abundant geothermal energy. Partnership with Marathon Digital for technical knowledge exchange.

ARGENTINA: Under Milei, is rapidly becoming a key player exploiting stranded natural gas resources for mining.

BHUTAN: 12,062 BTC worth $1.28 billion, equal to 27% of GDP. Used mining profits to finance a 50% salary increase for public employees.

The Geopolitical Pattern: IMF vs. Bitcoin

There's a very clear pattern: all these countries - Pakistan, Ethiopia, Kenya, Argentina - have IMF agreements and have started government mining.

It's not coincidence. It's Bitcoin as a tool of financial sovereignty.

Daniel Batten, climate tech analyst, said it clearly: "The IMF is terrified that Bitcoin will break its debt hegemony and will continue to oppose Bitcoin adoption at the nation-state level."

The Bhutan Model: The Silent Blueprint That Worked

Bhutan has been mining Bitcoin secretly for years, starting when the price was around $5,000. Now it has 12,062 BTC representing almost 27% of GDP, making it the fifth largest government holder worldwide.

The Bhutan Strategy is genius: During summer months, there's more water flow and hydroelectric plants generate more energy than needed. Where export tariffs to India are good, they sell electricity. Where they're not good, they keep the energy and use it to mine Bitcoin.

Between July 2021 and June 2023, Bhutan invested almost $500 million in crypto mining facilities. In partnership with Bitdeer, they announced a $500 million green crypto fund.

The Result: In June 2023, a portion of the government's Bitcoin holdings was used to finance a 50% salary increase for public employees.

Competitive Mining: The New Gold Rush

Ethiopia is one of the fastest-growing Bitcoin mining markets, capitalizing on its abundant hydroelectric energy. However, the country faces challenges from political instability and intermittent civil conflict.

But it's precisely this instability that makes Bitcoin attractive. Unlike gold or oil, Bitcoin can be "transported" instantly across borders and oceans. It's pure digital sovereignty.

The Network Effect: When the Big Follow the Small

What makes this movement irresistible is the network effect. When Bhutan demonstrates that Bitcoin mining can bootstrap an economy, other countries take note.

When Pakistan uses Bitcoin as a negotiation tool with the IMF, it establishes a precedent.

When the United States creates a Strategic Bitcoin Reserve, it completely legitimizes the asset at a geopolitical level.

PART IV: On-Chain Data - The Science Behind the Storm

The MVRV Z-Score: We're Just at the Beginning

All these macro and institutional flows would be useless if Bitcoin were already overvalued. But here's the most exciting part: all on-chain indicators say we're just at the beginning.

The MVRV Z-Score currently suggests we still have significant upside potential. While previous cycles have seen the Z-Score reach values above 7, we're still at levels comparable to May 2017 when Bitcoin was worth only a few thousand dollars.

The 200 Week Moving Average: Bitcoin's Lifeline

In each of its major market cycles, Bitcoin has historically touched the bottom around the 200 week moving average.

The 200WMA Heatmap is a tool I use religiously. It uses a colored heatmap based on percentage increases of the 200 week moving average. Historically, when we see orange and red dots, it's been a good time to sell Bitcoin.

According to Lookonchain's analysis on the 200 Week Moving Average Heatmap, Bitcoin's current price point is blue, suggesting the price top hasn't been reached, making it an opportune time to hold and buy.

The Math is Clear:

The blue zone of the heatmap has historically correlated with a 70% probability that Bitcoin's price will increase in the following month.

Bitcoin has spent very little time below the 200 week moving average in over ten years, confirming we're still in accumulation territory, not distribution.

Volatility Analysis: The BlackRock Paradox

One of the most interesting patterns of 2025 is what's happening with Bitcoin volatility.

The 90-day rolling volatility of the BlackRock Bitcoin Trust ETF has dropped to 47.64, the lowest level since it debuted.

According to Bloomberg analyst Eric Balchunas, low volatility is attracting institutional capital, creating a feedback loop that further stabilizes the ETF.

This is significant because it suggests Bitcoin is entering a "maturation" phase where extreme volatility decreases, but not due to lack of interest - on the contrary, due to too much institutional interest.

ETF Flows: The Thermometer of Institutional Demand

ETF numbers tell a story of insatiable demand:

The BlackRock IBIT registered $6.22 billion in inflows just in May 2025, the best month in the ETF's history.

Since it debuted, IBIT has attracted $49 billion in net inflows, more than four times the amount invested in the second-place Fidelity FBTC which has attracted less than $12 billion.

But the most interesting data is the consistency: IBIT registered daily inflows every day in May except one (May 13 with zero flows), and the ETF represents 90% of all spot Bitcoin ETF flows.

On April 29, 2025, IBIT registered $970.9 million in inflows, its second largest daily inflow since it was launched.

The Psychological Effect: When Demand Creates More Demand

There's something deeply psychological in what's happening. Eric Balchunas commented: "IBIT is 'essentially responsible' for all net inflows of spot crypto ETFs in May and for all of 2025."

This creates a momentum effect where:

Record inflows attract media attention

Attention attracts more institutional investors

Institutional investors bring more inflows

The cycle self-reinforces

The Bitcoin Cycle Master Chart: The Treasure Map

The Bitcoin Cycle Master Chart, which aggregates multiple on-chain valuation metrics, shows that Bitcoin still has considerable growth space before reaching overvaluation. The upper limit, currently around $190,000, continues to rise.

This is important because the Master Chart isn't based on a single indicator, but on the convergence of multiple on-chain metrics that have proven their effectiveness over several cycles.

Sentiment Analysis: Still Room for Euphoria

Analysts note three key indicators: MVRV, NUPL and SOPR. Each of these indicators showed clear signs of overheating weeks before the dramatic downturns of April 2021 and December 2017.

The crucial point is that we don't see these signals yet.

Currently, the bull run is still continuing, and based on analyst projections, the timeline is clear with targets until August 2025.

PART V: The Multiplier Effect - When the Three Forces Amplify Each Other

The Virtuous Circle Nobody Predicted

What makes this situation unprecedented are not the individual forces, but the way they're amplifying each other. It's a system of positive feedbacks creating a virtuous circle of geological proportions.

LIQUID → CORPORATE → SOVEREIGN → LIQUID:

Expansive global liquidity → more capital seeks returns → Bitcoin rises

Bitcoin rises → corporates with Bitcoin treasury see shares rise

Shares rise → more companies adopt Bitcoin strategy → more institutional demand

Institutional demand → governments see success and create strategic reserves

Strategic reserves → more legitimization → more liquidity enters the system

The cycle repeats, but amplified

It's not additive. It's multiplicative.

The Network Effect: How Value Grows Exponentially

Metcalfe's Law says the value of a network is proportional to the square of the number of users. With Bitcoin, we're seeing this principle applied on three levels simultaneously:

LEVEL 1 - MONETARY NETWORK: More holders → more liquidity → more stability → more adoption

LEVEL 2 - INSTITUTIONAL NETWORK: More corporate → more legitimacy → more corporate → imitation effect

LEVEL 3 - SOVEREIGN NETWORK: More governments → more pressure on other governments → competitive race

The Amplification Numbers

To understand amplification, let's look at what happens when these three effects combine:

The Supply Shock: Relentless Mathematics

With a fixed supply cap of 21 million Bitcoin, even modest accumulation by a few major players creates significant pressures.

Current Numbers:

Corporate: ~1M BTC (4.8% of total supply)

Governments: ~530k BTC (2.5% of total supply)

ETF: ~1.1M BTC (5.2% of total supply)

Combined Total: ~2.6M BTC = 12.5% of total supply already "locked"

But these numbers are growing rapidly:

Corporate: +31% in 2024, accelerating in 2025

Governments: from 2 to 15+ countries in 5 years

ETF: $85B+ in inflows in the first months of 2025

Perfect Timing: Astrological Convergence

What makes all this even more powerful is the timing. Not only are these three forces manifesting simultaneously, but they're manifesting at the perfect moment in the Bitcoin cycle.

HALVING CYCLE ALIGNMENT:

Halving 2024 → natural supply reduction

M2 breakout → increased liquidity-driven demand

Corporate adoption → increased structural demand

Sovereign reserves → increased geopolitical demand

It's as if the universe aligned to create perfect conditions for Bitcoin price explosion.

The Credibility Effect: The Circle of Trust

But perhaps the most powerful amplification is that of credibility. Each category of investor that enters legitimizes Bitcoin for the next category:

RETAIL → CORPORATE → INSTITUTIONAL → SOVEREIGN

When Strategy accumulates 580k Bitcoin and its shares perform well, this gives credibility to other corporates.

When BlackRock launches IBIT and raises $49B, this gives credibility to governments.

When the United States creates a Strategic Bitcoin Reserve, this removes any residual doubt about Bitcoin's legitimacy as an asset class.

PART VI: The Risks - The Clouds on the Horizon

Market Reality: Nothing Goes Up Forever

I would be dishonest if I didn't talk about risks. Every storm, however powerful, can subside. Every bull market has an end. And every asset, however revolutionary, has its vulnerabilities.

The Trinity of Convergence is powerful, but it's not invincible. Here are the points where the mechanism could jam:

RISK 1: The Corporate Dilution Problem

Matthew Seagull of VanEck raised the most critical point: if Bitcoin treasury companies start trading below Net Asset Value, every new issuance dilutes existing shareholders instead of creating value.

The Failure Mechanism: One company is already close to this dangerous level. If the trend spreads, we could see a complete reversal of the corporate strategy.

When a Bitcoin treasury company drops below NAV:

Can no longer issue shares to buy Bitcoin without diluting

Might be forced to sell Bitcoin for share buybacks

This creates selling pressure on the market

Other corporates might follow suit

The multiplier effect goes in reverse

Warning Signs to Monitor:

Strategy trading below $60B market cap (vs. $64B Bitcoin holdings)

Marathon, Riot, or other miners below NAV for more than 10 consecutive days

Announcements of "strategic reviews" by Bitcoin treasury companies

RISK 2: The IMF Geopolitical Conflict

The Pakistan case is emblematic of a broader systemic risk. Daniel Batten warns: "The IMF will use every technique at its disposal to preserve the monopoly it has enjoyed. If you have disruptive technology, don't expect the 'disrupted' to just watch."

The IMF Pattern: Batten argues that the IMF has a "4/4 track record" in blocking Bitcoin initiatives in debtor nations.

The mechanism is simple but brutal:

Country announces Bitcoin strategy

IMF threatens funding cuts

Country is forced to choose between Bitcoin and immediate liquidity

Majority chooses liquidity (survival instinct)

Bitcoin loses a potential government adopter

The Limit Case: If this pattern repeats with Pakistan, Argentina, Kenya, and other countries with IMF programs, we could see significant slowing in sovereign adoption.

RISK 3: Structural Volatility and Leverage

Strategy has $7.27 billion in outstanding convertible bonds. If Bitcoin crashes significantly, the company could find itself in financial stress.

The Debt Maturity Wall: Strategy has five bonds outstanding with a value of $4.25 billion. If Bitcoin falls below certain levels for prolonged periods, the company might be forced to sell Bitcoin to honor debts.

The Leverage Domino Effect:

Bitcoin falls 50-60% from current peaks

Strategy and other leveraged corporates under stress

Forced sales to liquidate positions

More pressure on Bitcoin price

Self-reinforcing negative spiral

RISK 4: The Market Maturation Problem

Bitcoin volatility is decreasing (47.64 for IBIT, the lowest since launch). This attracts institutional money, but also reduces attractiveness for hedge fund arbitrage.

The Stability Paradox:

Less volatility → less option value in convertible bonds

Less option value → higher rates for Strategy and imitators

Higher rates → less leveraged accumulation capacity

Less accumulation → less upward price pressure

RISK 5: The Federal Reserve Pivot

The entire liquidity mechanism depends on expansive M2. If the Fed were to drastically tighten liquidity (to fight inflation, for example), the main fuel of the Trinity would be removed.

Potential Triggers:

Inflation exceeding 5-6%

Crisis in Treasury bond market

Political leadership change with anti-crypto mandate

International pressure for capital flow control

PART VII: The Timing - When Will the Peak Arrive?

The Science of Cycle Timing

The question everyone asks: when will this party end?

Based on historical patterns, on-chain data, and the mechanics of the three forces, I see two main scenarios (plus one 😅) with different probabilities:

Exit Triggers: The Reverse Treasure Map

Regardless of which scenario manifests, I've identified four main triggers that will tell me when it's time to exit. These are not investment advice, but the signals I'll use for my personal strategy:

TRIGGER 1: MVRV Z-Score above 6.5 Historically, when the MVRV Z-Score exceeds 6.5, Bitcoin is in systemic overvaluation territory. This has happened before every major correction of the last 10 years.

The beauty of this indicator is that it gives warning weeks in advance, not days. When I see the Z-Score approaching 6, I start reducing exposure progressively.

TRIGGER 2: NUPL in "Extreme Euphoria" territory Net Unrealized Profit/Loss tells me when the entire Bitcoin network is sitting on profits so large that the temptation to sell becomes irresistible.

Historically, when NUPL enters the red zone (>0.75), we're close to a top. I don't wait for it to reach 0.9+ because at that point it's often too late.

TRIGGER 3: Corporates Starting to Sell The day Strategy, Marathon, or other major Bitcoin treasury companies announce "strategic" Bitcoin sales, that day the party is over.

It doesn't matter how they'll justify it - "rebalancing," "opportunities," "diversification." When corporate smart money starts selling, it's because they know something we don't know yet.

TRIGGER 4: Fed Aggressively Restricting Liquidity If the Fed starts contracting M2 aggressively or raising rates above 6-7%, the main fuel of the Trinity is removed.

This is the most dangerous trigger because it can happen quickly and without warning. It's the one I monitor most carefully.

The Importance of "When" vs. "What"

The truth is that predicting the "what" (maximum price) is much easier than predicting the "when" (exact timing).

On-chain models give me fairly reliable price ranges based on historical data. But timing is always the most difficult part.

For this reason, my strategy isn't based on predicting the exact top, but on:

Scaling out progressively as triggers activate

Maintaining core positions until at least 2 out of 4 triggers are active

Not trying to time the perfect top because it's impossible

PART VIII: My Operational Strategy - How I Navigate the Storm

Premise: This is My Personal Strategy

Before getting into details, I want to be clear: this is my personal strategy based on my analysis, my financial situation, and my risk tolerance.

And, above all, it's ONLY the part dedicated to Bitcoin.

It's not investment advice. Each person must evaluate their own situation, their own objectives, and their own capacity to bear significant losses.

Bitcoin remains a highly volatile and risky asset. Just because I've done this analysis doesn't mean it will be correct. Markets can remain irrational longer than we can remain solvent.

Current Allocation: The Convergence Portfolio

In light of the analysis conducted, here's how I'm concretely positioning my portfolio:

Operational Levels: The Tactical Map

NO SELLING BELOW $150,000 Macro and on-chain data don't support early distribution. Global liquidity has just entered expansive phase, corporates are accelerating accumulation, and governments are just beginning their strategic reserves.

Selling below $150k would mean selling before the Trinity of Convergence has deployed its full potential.

PROGRESSIVE SCALING OUT $180,000-250,000 This is the zone where, based on on-chain models and historical patterns, I should start gradually distributing.

$180k-200k: Sell 20% of direct Bitcoin + 30% treasury stocks

$200k-230k: Sell 30% of direct Bitcoin + 40% treasury stocks

$230k-250k: Sell 40% of direct Bitcoin + all treasury stocks

ALL-OUT ABOVE $350,000 If we reach these levels, we're probably in "final bubble" territory regardless of indicators. At these prices, capital preservation risk exceeds upside potential.

Operational Timeline: The Time Sequence

SHORT TERM (3-6 months): Total position maintenance. Zero selling regardless of short-term volatility.

Aggressive re-purchases on any significant dip below $90,000, which I'd see as final accumulation opportunity before the Trinity reaches full speed.

Global M2 has just entered breakout, and with the 12-week lag, we should see major acceleration in the next 3-6 months.

MEDIUM TERM (6-12 months): Intensive monitoring of:

MVRV Z-Score weekly readings for distribution timing

Corporate accumulation rate for plateau warning

Government adoption news for acceleration or deceleration

M2 growth rate for maintaining expansive territory

Start considering progressive sales only when at least 2 of the 4 main triggers activate.

LONG TERM (12+ months): If we enter the Extended Scenario (Q1 2026), I maintain core position until MVRV Z-Score >6.5 or significant corporate sales.

In this scenario, targets become $350k-500k, but with extreme caution for exit timing.

Risk Management: The Security System

STRATEGIC STOP-LOSS: $48,000 This is the only level where I'd consider panic selling. If Bitcoin drops below $48k and stays there for more than 30 days, it would mean something fundamentally disastrous happened with my analysis.

At this point, the Trinity of Convergence would probably have collapsed and I'd need to completely reconsider the thesis.

REBALANCING TRIGGERS:

If Bitcoin treasury stocks fall below NAV for >20 consecutive days → reduce exposure by 50%

If more than 3 countries with Bitcoin mining programs announce rollbacks → review sovereign scenario

If global M2 enters sustained contraction → immediate liquidation of 70% position

OPPORTUNISTIC BUYING: I always maintain 5-10% cash for accumulation opportunities on:

Flash crashes >20% in 48 hours

Major FUD events I know to be temporary

Technical corrections toward 200WMA support

Monitoring Dashboard: Critical KPIs

Every week I monitor these indicators in order of priority:

TIER 1 - CRITICAL:

MVRV Z-Score (target: <6.5)

Global M2 growth rate YoY (target: >3%)

Strategy NAV premium (target: >10%)

Corporate accumulation rate (target: >50k BTC/month)

TIER 2 - IMPORTANT: 5. NUPL levels (warning: >0.75) 6. SOPR spikes (warning: sustained >1.1) 7. Fed rates trajectory (warning: >6%) 8. ETF inflows consistency (warning: <$1B/month)

TIER 3 - CONTEXTUAL: 9. Government mining announcements 10. Major corporate Bitcoin purchases/sales 11. Regulatory developments 12. Technical support/resistance levels

Non-Negotiable Rules

NEVER SELL EVERYTHING: I always maintain at least 50% Bitcoin exposure even in worst case scenario

NEVER BUY WITH LEVERAGE: The analysis is strong but markets can be irrational

NEVER EMOTIONAL DECISIONS: Follow systematic framework even under stress

NEVER CHASE PERFORMANCE: Don't increase allocation if Bitcoin outperforms beyond expectations

ALWAYS KEEP A RECORD: Every decision must be logged with rationale for future reference

Psychological Preparation: The Mental Battle

The hardest part won't be technical analysis or market timing. It will be managing emotions when Bitcoin reaches $150k, $200k, or maybe even $300k+.

At $150k the temptation to sell everything will be enormous. Media will be in frenzy, social media full of "I made millions with Bitcoin," and instinct will be to take profits.

At $200k the FOMO of not selling too early will conflict with fear of losing everything if it crashes.

At $300k+ if we get there, it will be pure madness. Euphoria will be so intense that even the most hardcore bitcoin maximalists will start selling.

This is why I've created a systematic framework with predefined triggers. When emotions are at maximum, I must rely on the system, not feelings.

PART IX: Alternative Scenarios - What If I'm Wrong?

Scenario A: The Premature Plateau

What happens if: The Trinity of Convergence exhausts itself earlier than expected, Bitcoin reaches only $120k-150k and then enters prolonged bear market.

Probability: 20%

Possible causes:

Corporate dilution becomes systemic problem earlier than expected

FED aggressive pivot toward tightening to fight inflation

Major geopolitical event destabilizing global markets

Coordinated USA-Europe regulatory crackdown

My response: I'd sell 30% of direct Bitcoin position if I see prolonged stagnation above $120k with MVRV Z-Score not rising. I'd maintain 40% core position in case of delayed recovery.

Scenario B: The Final Bubble

What happens if: Bitcoin goes full mania mode, reaches $500k-1M in 6 months, then 80%+ crash.

Probability: 15%

Possible causes:

Perfect storm of all three forces accelerating simultaneously

Sudden China policy reversal + massive buying

Major fiat currency crisis pushing Bitcoin beyond the moon

Technology breakthrough revolutionizing use cases

My response: I'd sell 80% of everything above $400k regardless of indicators. At these levels, capital preservation exceeds gain optimization.

Scenario C: The Crash Before the Pump

What happens if: Bitcoin crashes below $60k before the Trinity fully deploys.

Probability: 10%

Possible causes:

Forced liquidation of Strategy due to debt stress

Major quantum computing breakthrough compromising security

More aggressive coordinated government ban than expected

Macroeconomic black swan (war, pandemics, financial crises, and various ad hoc shenanigans)

My response: I'd aggressively buy every dip below $70k until liquidity reserves exhaustion. If it drops below $45k, stop everything and completely review analysis (while sending my wife's resume around 🤣).

Scenario D: The Fakeout Rally

What happens if: Bitcoin rallies to $130k-160k, makes "dead cat bounce" to $80k, then new rally to $300k+.

Probability: 25%

Possible causes:

Double-peak cycle like 2013

Temporary institutional profit-taking followed by re-accumulation

Regulatory clarity removing overhang and triggering second wave

Technical consolidation before final leg up

My response: This is the most dangerous and tiring scenario for the psychological part. I'd need to resist the temptation to sell in the first peak and rebuy in the dip. I'd maintain strategic patience based on fundamentals.

The Importance of Intellectual Humility

The truth is nobody knows what will happen. My analysis is based on the best available data, solid historical patterns, and logical reasoning. But markets can remain irrational longer than we can remain solvent.

For this reason:

I never put more than 85% in crypto (including correlated stocks)

I always maintain plan B and C for scenarios I haven't considered

I review analysis monthly based on new data

I don't fall in love with my thesis - if data changes, I change opinion

I document everything to learn from successes and mistakes for the future

The Trinity of Convergence is the most convincing analysis I've ever done on Bitcoin. But it remains an analysis, not a guarantee.

PART X: Historical Significance - Beyond the Money

We're Witnessing a Monetary Revolution

What's happening with Bitcoin goes beyond prices, gains, or even wealth creation. We're witnessing - and participating in - a paradigmatic shift that happens once every century.

The Last Change of This Type: Abandoning the gold standard in 1971.

Before 1971, money was anchored to something physical and scarce (gold). After 1971, money became fiat - created from nothing, controlled by governments, subject to political pressures of the moment.

For 54 years we've lived in the fiat era. And now, for the first time, we have a credible alternative.

The Geopolitics of Money

What makes this revolution so profound is that it's not just technology. It's geopolitics.

When Pakistan uses Bitcoin to negotiate with the IMF, when Bhutan relaunches its economy with mining, when the United States creates a Strategic Reserve, these aren't just investment decisions.

They're acts of monetary sovereignty.

For the first time since the dollar became the world's reserve currency, we have an asset that:

Is controlled by no government

Cannot be printed or degraded

Is accessible to anyone with internet

Transfers value across boundaries instantly

The Network State in Action

Bitcoin is demonstrating a concept that seemed theoretical: the network state.

An entity that exists in cyberspace, has its own currency, rules, and community, but has no geographical boundaries. Traditional states can regulate it, but cannot completely control it.

This creates natural tension with existing power structures, but also opportunities for cooperation (as we see with strategic reserves).

The Generational Effect

It's not just institutions and governments going orange. It's an entire generation.

Generation Z and Millennials are digital natives who grew up during the 2008 Financial Crisis, saw zero interest rates for 15 years, and watched house prices explode.

For them, Bitcoin isn't "strange new technology." It's the obvious solution to a system they feel is rigged against them.

The Great Wealth Transfer

We're also in the middle of the greatest wealth transfer in history: Baby Boomers transferring wealth to their children and grandchildren.

This younger generation has much more openness to cryptocurrencies, much less trust in traditional institutions, and much more comfort with digital assets.

In the next 10-20 years, trillions of dollars will pass from a generation that prefers stocks and real estate to one that prefers cryptocurrencies and digital assets.

The System's Irony

There's profound irony in what's happening:

The fiat system that was designed to give governments more control over monetary policy is creating conditions that favor an asset that removes that control completely.

Quantitative easing, zero interest rates, massive public debt: all these policies are pushing capital toward Bitcoin as an escape valve.

Central bankers are inadvertently financing the revolution against their own system.

CONCLUSION: The Historical Moment That Won't Return

What I've Learned in 10 Years of Bitcoin

I've seen Bitcoin born from a 9-page white paper and become a trillion-dollar asset. I've witnessed 4 major cycles, hundreds of "Bitcoin is dead," and hundreds of "competitors" trying to dethrone it.

But what's happening now is different.

It's not just another cycle. It's not just another bull market. It's the institutionalization of a revolution.

The Trinity That Changes Everything

The simultaneous convergence of explosive liquidity, corporate weaponization, and sovereign adoption creates conditions we've never seen before and will probably never see again in the same combination.

Why it won't return:

First time: You can only be one of the first institutional adopters once

Network effects: The Bitcoin network becomes more stable as it grows

Liquidity: Less volatility means fewer opportunities for extreme gains

Competition: Other digital assets absorb part of speculative flows

Regulatory clarity: Removes uncertainty premium but also upside potential

The Opportunity Paradox

Here's the paradox: the more Bitcoin succeeds, the less explosive the returns become.

If Bitcoin reaches $250,000-500,000 in this cycle and then stabilizes as an accepted global reserve asset, future returns could be much more modest, perhaps in line with traditional asset classes.

This could be the last great opportunity for life-changing gains from Bitcoin.

Why Most People Will Miss This Opportunity

Not because they don't have access to information. The analysis is here, the data is public, the patterns are clear.

They'll miss it because:

Disbelief: "Bitcoin can't really reach over $200,000"

Timing anxiety: "I'm too late, it's already at $100,000"

Complexity aversion: "I don't understand corporate treasury strategies"

Status quo bias: "Traditional assets have always worked"

Social proof dependence: "My financial advisor says cryptocurrencies are risky"

When all these doubts are resolved, Bitcoin will have already passed $300k and the opportunity for maximum gain will have passed.

The Personal Test

If I had to do the most honest test of this analysis, I'd ask myself:

"Are you willing to bet big on this conviction?"

The answer is yes. I've allocated 85% of my net worth to this thesis through direct Bitcoin holdings and correlated stocks.

Not because I'm reckless or because I think it's risk-free. But because:

Risk-return asymmetry: Potential upside (5-10x) vs. potential downside (50-80%) creates favorable asymmetry

Unrepeatable setup: Trinity convergence won't return in this form

Strong confidence: Multiple independent analyses reach the same conclusion

Acceptable timeline: Portfolio can support 2-3 years for thesis to unfold

Manageable downside: Even in worst case, I can recover financially

The Final Consideration

Bitcoin could go to zero. The entire crypto space could collapse. Governments could ban everything. Technology could be compromised.

These are all real possibilities I cannot ignore.

But when weighing these risks against the probability and magnitude of the Trinity Convergence, for me the decision is clear.

The Final Message

I'm not telling you to follow my strategy. I'm not telling you to buy Bitcoin. I'm not telling you to take any specific action.

I'm just sharing the most complete analysis I've ever done, the thinking behind my decisions, and the data that convinced me we're living through a unique historical moment.

The rest is up to you.

The Trinity of Convergence is here. The data speaks clearly. The models are aligned. The opportunity is enormous.

The question isn't whether Bitcoin will continue to rise - given the fundamentals, that seems almost inevitable in the medium term.

The question is whether you'll position yourself to capture what could be the greatest wealth creation event of our lifetime.

The perfect storm is here. The only question that remains is:

Are you ready for the storm of the century?

FINAL DISCLAIMER

All analyses, forecasts, and strategies contained in this article are based on historical data, market models, and personal opinions. They do not constitute guarantees of future performance and should not be considered investment advice.

Cryptocurrency markets remain highly volatile and unpredictable. All investments carry the risk of significant losses. Always invest only what you can afford to lose completely.

This analysis reflects my personal opinion at the time of writing and may change without notice based on new information.

Always do your own research. Always diversify appropriately based on your situation. Always consult qualified financial advisors before making important investment decisions.

💊 💉 🍹 Additionally, I may have written this article under the influence of psychedelic substances, opioids, and/or other consciousness-altering substances.

😉

A hug, Riccardo

To stay updated, you can follow me on:

👉 If you find this article useful, please leave a 'like' and don't forget to subscribe to receive more updates on the world of cryptocurrencies, investments, and finance.

COMPLETE LEGAL NOTICE

This document provides analysis and interpretations of global economic trends that solely reflect the author's personal opinions. It does not constitute financial advice or investment recommendations. The information and forecasts are based on sources believed reliable, but no guarantees are made regarding their accuracy. Financial markets involve high risks and past performance does not guarantee future results. Before making any investment decision, it is recommended to conduct independent research and consult an authorized financial advisor who can provide personalized advice based on your risk profile and financial objectives.