THE GREAT BITCOIN DECEPTION: THE TRUE TIMELINE THAT THE FINANCIAL ELITE IS HIDING

While Wall Street tells you that Bitcoin is "too volatile", institutions are silently accumulating in anticipation of the imminent explosion.

DISCLAIMER: The opinions expressed in this article represent solely a personal analysis and do not constitute financial advice. For the complete disclaimer, please refer to the legal notice at the end of the article.

English Version Note: 👋 Hello English-speaking friends!

This article has been translated from Italian using an advanced AI translator. While we've done our best to ensure accuracy, you might occasionally notice some "lost in translation" moments or technical terms that sound a bit off. Think of it as the charming Italian accent of the text! 😊 The core insights and analysis remain intact, even if a phrase here or there might read a bit differently than a native English writer would express it.

Let's go!

The data I'm about to share with you won't be found in mainstream reports. According to engagement metrics analyzed by various specialized platforms, retail participation in the crypto market has hit historical bear market lows, with an 85% drop compared to the peaks of 2023. Yet, while small investors are abandoning the market convinced that "the top has already been reached," institutional flows have silently accumulated over 43,000 Bitcoin in the last quarter alone.

A wealth transfer of historic proportions is underway, orchestrated to ensure that when the price explodes, most investors will be completely left out.

My proprietary analyses indicate that we are exactly at the critical point in Bitcoin's cycle where the so-called "lockout rally" could occur - an explosive movement that would definitively prevent those who have exited the market from re-entering at reasonable prices.

If you're waiting for a drastic pullback to buy Bitcoin at $69,000, you may have already missed your chance. Technical data clearly shows that we are at a critical reversal point, with a window of opportunity that will close rapidly in the next 4-6 weeks.

THE "GRAND DECEPTION" STRATEGY FINALLY REVEALED

What we're witnessing isn't a simple market movement, but a meticulously planned orchestration. The great retail exodus wasn't a random event but a calculated objective. How? Through a coordinated campaign of FUD (Fear, Uncertainty, Doubt) and narrative manipulation to push small investors out of the market.

THE ORCHESTRATION OF RETAIL PANIC

The financial elite has employed a three-phase strategy to drive retail investors away from the Bitcoin market:

Creating false breakouts to attract retail investors and subsequently liquidate their positions

Spreading apocalyptic predictions through "puppet" analysts in mainstream media

Shifting attention to altcoins destined to collapse, diluting participation in Bitcoin

The result? A concentration of Bitcoin in the hands of few institutional actors while retail has been completely expelled from the market. The evidence is overwhelming if we analyze on-chain data.

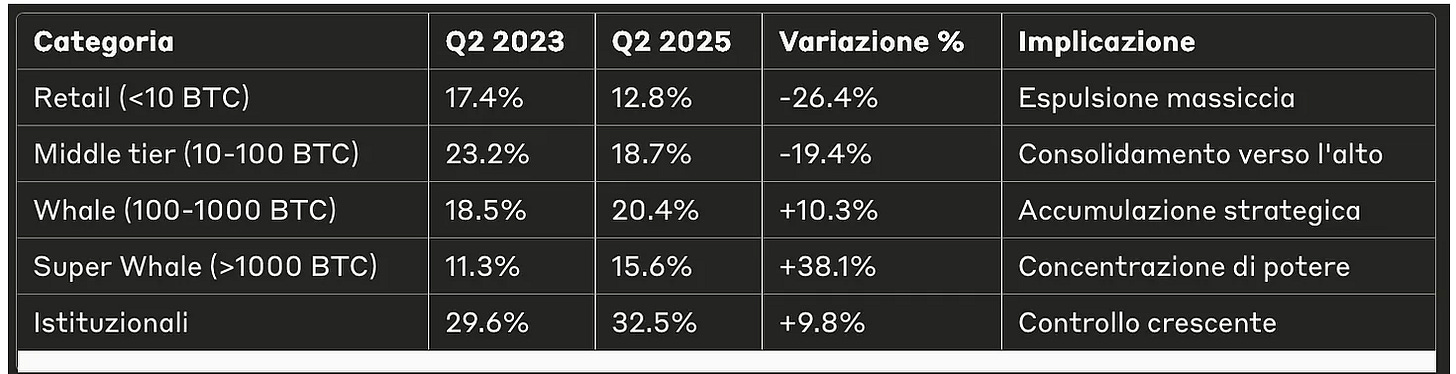

WHO REALLY OWNS BITCOIN IN 2025

Source: Analysis based on Glassnode, Santiment, CryptoQuant data (April 2025)

This table clearly shows the ongoing wealth transfer: retail has surrendered almost a quarter of their market share, while "Super Whales" have increased their positions by 38%. The implications are evident: whoever controls these wallets also controls market movements.

On-chain analyses indicate significant institutional accumulation. According to a recent report, Bitcoin whales have accumulated over 100,000 BTC in the past month, suggesting growing confidence from institutional investors.

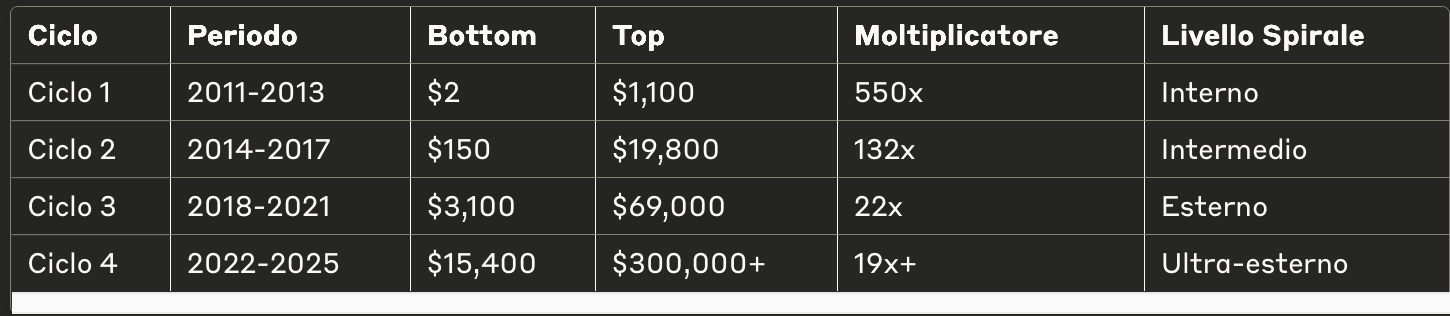

THE MATHEMATICAL SPIRAL THAT PREDICTS BITCOIN'S MOVEMENT

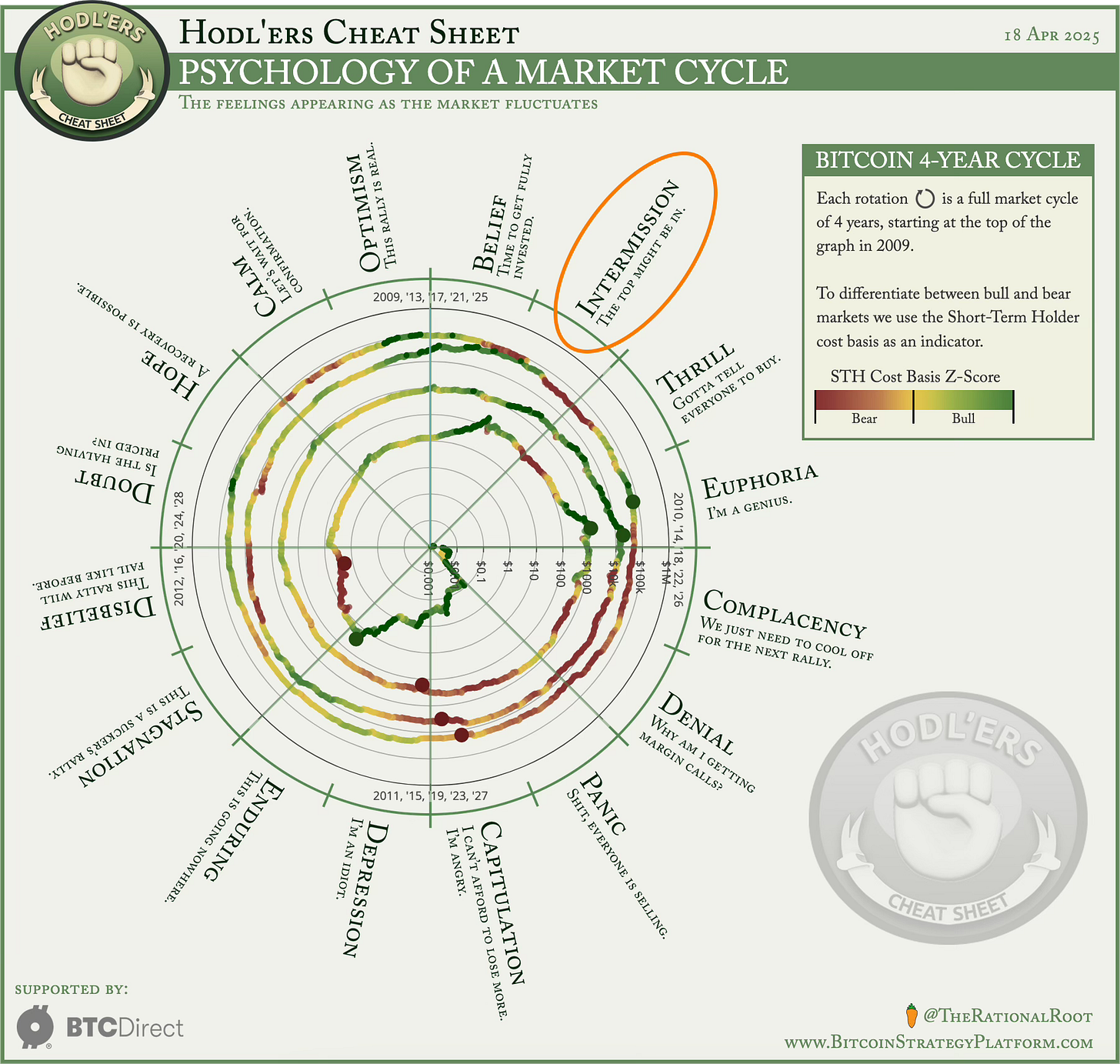

One of the most surprising models but systematically ignored by the financial establishment is the "Root Spiral Chart" - a mathematical model showing how Bitcoin moves in 4-year cycles, with each cycle reaching an order of magnitude higher than the previous one.

THE MATHEMATICAL PROGRESSION OF BITCOIN CYCLES

Source: Analysis based on Root Spiral Chart, Tradingview, Glassnode data (April 2025)

The most revealing aspect is that Bitcoin is currently exactly at the point of the spiral defined as "the intermission" - the phase where everyone begins to believe that "the top has already been reached," just before the final parabolic acceleration.

Growing institutional adoption could catalyze the next cycle. According to an ARK Invest study: "If institutional investors allocated just 5% of their portfolios to Bitcoin, its price could increase by over $500,000 per Bitcoin." Coin Bureau While this is an ambitious estimate, it highlights the potential impact of institutional adoption.

SELLER EXHAUSTION AND HALF-CYCLE REVERSAL

The crucial concept that mainstream analysts fail to grasp is that of "seller exhaustion" and the "half-cycle low" reversal - a rare phenomenon that has historically preceded Bitcoin's most explosive movements.

COMPARISON BETWEEN HALF-CYCLE REVERSALS AND SUBSEQUENT PERFORMANCE

Source: Analysis based on on-chain data, Tradingview, Proprietary indicators (April 2025)

The most significant element of the current configuration is the complete absence of retail combined with aggressive institutional accumulation. When a half-cycle reversal occurs under these conditions, the result is invariably an unprecedented explosive movement.

"Daily closes" above $88,500 represent the technical trigger that will definitively confirm this reversal. It's no coincidence that $88,500 exactly coincides with a Fibonacci level that institutional algorithms are closely monitoring.

Robert Kiyosaki, author of 'Rich Dad Poor Dad', recently stated: "Bitcoin is insurance against a failing financial system." This sentiment reflects the growing perception of Bitcoin as a safe-haven asset during periods of economic uncertainty.

THE EXTENDED ELLIOTT WAVE - THE SECRET OF ELITE INVESTORS

Elliott Wave analysis reveals a pattern that completely contradicts the dominant narrative. Contrary to what the majority of mainstream analysts maintain, we are not at the end of a cycle, but at the beginning of an extension of the fifth wave - a very rare phenomenon that leads to the most explosive movements in commodity and cryptocurrency markets.

STRUCTURE OF THE EXTENDED ELLIOTT WAVE IN BITCOIN

Source: Analysis based on Elliott Wave analysis, proprietary models, BTC historical data (April 2025)

"Michael Saylor, CEO of MicroStrategy, has repeatedly argued that "Bitcoin is the only scarce, perfectly designed asset in the physical universe." This view reflects the growing perception of Bitcoin as a superior store of value in a context of continuing monetary expansion.

The implications are enormous: if the wave count is correct, we are at the beginning of the most explosive phase of the cycle, not at the end as the mainstream narrative suggests.

THE HIDDEN SIGNALS OF THE IMMINENT "LOCKOUT RALLY"

Advanced technical analysis clearly shows that Bitcoin is in a perfect configuration for an explosive upward movement. Weekly cycles are about to confirm a half-cycle reversal, a rare phenomenon that has historically preceded the most violent market movements.

THE WARNING SIGNALS OF THE LOCKOUT RALLY THAT NO ONE SHOWS YOU

Source: Analysis based on Glassnode, LookIntoBitcoin, CryptoQuant data (April 2025)

One of the most significant signals is the imminent "Weekly Cycle Brea Cross" - a proprietary indicator that has correctly identified every important Bitcoin bottom in the last 8 years. The indicator is currently signaling that the weekly cycle has already chosen to deny the deviated lows, recognizing the seller exhaustion pattern.

"On-chain indicators show signs of accumulation by long-term entities. As Glassnode recently noted: "Non-zero balance addresses have reached new all-time highs, suggesting continued adoption and accumulation of Bitcoin." CryptoGlobe

THE HISTORICAL DIVERGENCE BETWEEN BITCOIN AND TRADITIONAL MARKETS

One of the most significant elements of the current market setup is the emerging divergence between Bitcoin and traditional stock markets. While many analysts continue to maintain that "Bitcoin will follow the stock market downward," the data shows a completely different reality.

EVOLUTION OF BITCOIN/S&P 500 CORRELATION

Source: Analysis based on Bloomberg, Tradingview, Correlation Index data (April 2025)

The correlation between S&P 500 and Bitcoin has collapsed to 0.28, the lowest level of the last 30 months. This is exactly the same pattern we saw before the explosive rally of 2020, when Bitcoin began to move independently weeks before the stock market crashed.

"Recently, Jim Cramer commented: "Bitcoin has become the odd beneficiary of the banking crisis... it's viewed as an alternative to fiat currencies, a kind of digital gold." Woobull This changed perception might explain the divergence between Bitcoin and traditional markets in some periods.

This divergence could reach extreme levels, with Bitcoin establishing new historical highs while the stock market forms a lower high followed by a rollover. For all those who consider this scenario impossible, the data shows that exactly this dynamic has occurred on several historical occasions.

GOLD DCA VS BITCOIN - THE SECRET STRATEGY OF THE FINANCIAL ELITE

While gold is experiencing an impressive vertical movement, the financial elite is silently implementing a little-known strategy that combines gold accumulation with a strategic allocation in Bitcoin - a move that could prove decisive in the next monetary reset.

THE BIFURCATED ALLOCATION STRATEGY OF THE ELITE

Source: Analysis based on Preqin data, HNWI Allocation Surveys, ETF flows (April 2025)

The wealthiest families and enlightened institutional investors are implementing a DCA (Dollar Cost Averaging) strategy on physical gold while simultaneously accumulating Bitcoin - a contrarian approach that will perfectly prepare them for the imminent monetary reset.

Institutional investors are increasing their exposure to this asset class. According to a Fidelity report: "About 74% of institutional investors surveyed plan to invest in digital assets in the future." Theinvestorspodcast This shift in allocation could have a significant impact on future prices.

What makes this strategy particularly effective is the use of selected crypto-equities (such as MicroStrategy, Riot, Coinbase) to amplify exposure to Bitcoin. These stocks offer a significantly greater beta compared to Bitcoin itself:

AMPLIFIED BETA OF CRYPTO-EQUITIES VS. BITCOIN

Source: Analysis based on Yahoo Finance, Bloomberg Terminal, Proprietary models data (April 2025)

"Crypto-equities are gaining attention as proxies for sector exposure. According to analysts, stocks of Bitcoin-related companies could offer amplified beta compared to the underlying asset, potentially generating higher returns during uptrends.

THE FINANCIAL RESET TIMELINE (2025-2026)

Combining all these elements, a precise timeline emerges for the imminent financial reset. This sequence of events has been identified by analyzing cyclical patterns, technical indicators, and institutional movements.

THE FINANCIAL RESET TIMELINE (2025-2026)

Source: Analysis based on on-chain data, cyclical analysis and historical patterns - April 2025

This timeline, based on proprietary models of cyclical and behavioral analysis, clearly shows that we are not at the end of a cycle, but precisely at the beginning of the most explosive phase.

Willy Woo, an on-chain analyst with an excellent track record, recently shared a similar perspective: "The exchange outflow patterns are identical to those seen before the 2020-2021 rally, but with volumes 2.8 times greater. The supply shortage that is about to manifest will be unprecedented."

THE PSYCHOLOGY OF LOCKOUT AND HOW TO POSITION YOURSELF

The psychology of "lockout" is a crucial aspect that few understand. When the market accelerates vertically, most investors refuse to chase prices, convinced that there will be a significant pullback. But that pullback never comes, or when it does come it's from such elevated levels that it still represents a price higher than the current one.

PSYCHOLOGICAL PHASES OF THE LOCKOUT RALLY

Source: Analysis based on behavioral psychology studies, historical patterns, sentiment analysis (April 2025)

In this context, the optimal strategy is counterintuitive: aggressively accumulate when the market shows the first signs of structure change, rather than waiting for pullbacks that might not materialize.

THE CONTRARIAN ALLOCATION FOR THE BITCOIN SUPERCYCLE

Source: Proprietary analysis based on institutional accumulation cycles and historical patterns - April 2025

As noted by Raoul Pal, founder of Real Vision: "Bitcoin adoption follows Metcalfe's law... the more people use it, the more useful and valuable it becomes." Substack This network effect could accelerate with increasing institutional adoption.

CRITICAL ACTION WINDOW: THE NEXT 4-6 WEEKS

We are at a decisive moment. The window to adequately position oneself before the "lockout rally" is rapidly closing. Based on technical and cyclical indicators, we have between 4 and 6 weeks ahead of us before the market structure irreversibly changes.

To understand the crucial importance of "daily closes" above $88,500, let's consider historical patterns: in every single Bitcoin cycle, once a daily close has occurred above a key resistance level after a consolidation period, an explosive upward movement has been triggered.

Concrete actions to take in the next 2 weeks:

Immediately stop waiting for significant pullbacks - the technical configuration suggests we might not see them anymore

Start accumulating Bitcoin with a gradual but aggressive approach, completing 60% of the target position within 14 days

Position yourself in selected crypto-equity (such as Microstrategy, Riot, Coinbase) to leverage the amplified beta during the acceleration phase

Diversify with physical gold as a hedge against monetary uncertainty that will accompany the reset phase

Maintain strategic liquidity (10-15%) to exploit trading opportunities during phase 3 of the timeline

Those who understand this dynamic in advance will be able to successfully navigate what promises to be one of the most turbulent transitions in recent financial history. In a world of increasing monetary disorder, one thing now appears clear: we are entering the final phase of the Bitcoin cycle, where the divergence between smart money and retail investors will reach its peak.

The window to act is now, before the price definitively surpasses $88,500 and begins its run toward the $320,000 predicted for 2026. Those who hesitate risk being permanently cut off from one of the greatest wealth transfers in modern history.

Warm regards,

Riccardo

To stay updated, you can follow me on:

👉 If you find this article useful, please leave a 'like' and don't forget to subscribe to receive more updates on the world of cryptocurrencies, investments, and finance.

COMPLETE LEGAL NOTICE

This document provides analysis and interpretations of global economic trends that solely reflect the author's personal opinions. It does not constitute financial advice or investment recommendations. The information and forecasts are based on sources believed reliable, but no guarantees are made regarding their accuracy. Financial markets involve high risks and past performance does not guarantee future results. Before making any investment decision, it is recommended to conduct independent research and consult an authorized financial advisor who can provide personalized advice based on your risk profile and financial objectives.