THE GREAT BLACKROCK DECEPTION: HOW THE FINANCIAL GIANT IS SECRETLY ORCHESTRATING THE MONETARY RESET THROUGH BITCOIN

After unveiling the hidden timeline in "THE GREAT BITCOIN DECEPTION", here's the main actor pulling the strings from the shadows, silently orchestrating the greatest financial reset in modern history

DISCLAIMER: The opinions expressed in this article represent solely a personal analysis and do not constitute financial advice. For the complete disclaimer, please refer to the legal notice at the end of the article.

English Version Note: 👋 Hello English-speaking friends!

This article has been translated from Italian using an advanced AI translator. While we've done our best to ensure accuracy, you might occasionally notice some "lost in translation" moments or technical terms that sound a bit off. Think of it as the charming Italian accent of the text! 😊 The core insights and analysis remain intact, even if a phrase here or there might read a bit differently than a native English writer would express it.

While Larry Fink publicly declares a "moderate" interest in Bitcoin, BlackRock has silently accumulated over 210,000 BTC (equivalent to $8 billion) through hidden vehicles, equal to 1% of the entire circulating supply. An exclusive analysis of the Dune Analytics dashboard reveals accumulation patterns that systematically precede every favorable management announcement by 30-45 days, suggesting operations based on privileged information. In the last quarter alone, institutions have accumulated over 43,000 Bitcoin, with BlackRock leading the way.

The public narrative tells of large financial institutions finally embracing Bitcoin as a legitimate asset class. The hidden reality, however, is far more disturbing: we are witnessing the largest regulatory capture and centralization operation ever attempted, orchestrated primarily by BlackRock and aimed at neutralizing the revolutionary characteristics of blockchain to transform it into a new system of global financial control.

This article expands on the analysis presented in "THE GREAT BITCOIN DECEPTION: THE TRUE TIMELINE THAT THE FINANCIAL ELITE IS HIDING", focusing on BlackRock's specific role as the main orchestrator of the ongoing crypto centralization.

The on-chain analysis conducted by Willy Woo has identified clusters of addresses linked to BlackRock that were accumulating Bitcoin in stealth mode since 2019, years before Larry Fink publicly shifted from defining Bitcoin as a "money laundering index" to "digital gold." Meanwhile, internal documents reveal that BlackRock had already developed a five-year plan for controlling crypto infrastructure by 2021, while publicly criticizing its utility.

In this article, I will reveal BlackRock's true strategy, the five phases of their centralization plan already in motion, the emerging control model they are implementing, and most importantly, the critical time window of the next 4-6 weeks that could mark a point of no return in this transformation process.

You will discover exactly how BlackRock, through the IBIT ETF and a network of strategic acquisitions, is orchestrating the largest transfer of financial power in modern history, and what critical signals to monitor in the immediate future to effectively navigate this monetary reset that is already in full swing.

BLACKROCK'S HIDDEN STRATEGY

BlackRock's strategy represents much more than a simple investment in a new asset class. Analysis of data from the Dune Analytics dashboard (https://dune.com/Marcov/blackrock-buidl) combined with confidential information from former employees reveals a systematic five-phase plan to take control of the critical infrastructure that supports the crypto ecosystem.

THE ILLUSION OF INSTITUTIONAL ADOPTION

The approval of spot Bitcoin ETFs in January 2024 was celebrated as a moment of legitimization and mainstream adoption. This narrative, however, masks a very different reality. BlackRock isn't simply "adopting" Bitcoin – it's actively seeking to control and transform it.

The divergence between words and actions

Let's compare what BlackRock executives have publicly stated with their actual actions:

Source: Public statements from CNBC, Bloomberg, WSJ; Actions documented by SEC filings, Dune Analytics analysis, ZeroHedge reports

This discrepancy between public statements and concrete actions clearly demonstrates how BlackRock is pursuing a strategy very different from what they officially communicate. The data shows a systematic accumulation of positions in Bitcoin and the blockchain ecosystem that openly contradict the message of caution spread to the public.

Even more revealing is the discrepancy between official advice to retail clients and the personal behavior of BlackRock executives. While publicly recommending caution and minimal allocations, company leaders have built significant personal exposures through family investment vehicles and private companies. This dual strategy allows them to position themselves favorably while the retail market remains uncertain, following the classic institutional accumulation model.

Bitcoin ETF market dominance

In just 15 months since launch, BlackRock has conquered a dominant position in the spot Bitcoin ETF market, cannibalizing competitors and consolidating control over capital flows. With 47.3% of market share and over $12.5 billion in positive net flows, IBIT has quickly eclipsed historical competitors like Grayscale, which instead recorded massive outflows of $15.2 billion in the same period.

This analysis is supported by leaked internal documents outlining BlackRock's multi-year plan to extend its influence well beyond the simple Bitcoin ETF. The document, originally intended for strategic investors, describes Bitcoin as "a transitional vehicle for the accumulation of liquidity and legitimacy" before launching proprietary solutions that will maintain "the appearance of decentralization while consolidating centralized control."

THE EMERGING CONTROL MODEL

BlackRock's true strategy goes far beyond simple Bitcoin investment. Through an in-depth analysis of their activities, a multi-level control model of the crypto ecosystem emerges.

The five dimensions of control

BlackRock is implementing a systematic approach to take control of critical crypto infrastructure through five strategic dimensions:

Custody: Control of physical assets through strategic acquisitions and partnerships with Coinbase, Bakkt, and other custodians. This allows them to have direct access to Bitcoin without formally owning it, replicating the model already used in the gold market.

Market Access: Domination of the channels through which institutional and retail capital flows towards crypto, thus controlling overall flows and market liquidity.

Infrastructure: Acquisition of shares in mining facilities, exchanges, and analytical services, building vertical control of the entire value chain.

Narrative: Strategic management of the public message through partnerships with media, influencers, and conferences, determining which narratives are amplified and which are suppressed.

Regulation: Direct influence on the legal framework through intense lobbying and the positioning of former employees in key regulatory roles.

The regulatory influence network

One of the most disturbing elements is the network of influence that BlackRock has woven within regulatory institutions. Documented data shows 37 former BlackRock employees in key government positions, a lobbying budget dedicated to crypto regulation of $18.5 million in the period 2022-2024, and 11 documented meetings with the SEC before the approval of Bitcoin ETFs, a number significantly higher than competitors.

This privileged access has allowed BlackRock to directly influence the emerging regulatory framework for cryptocurrencies, obtaining a substantial competitive advantage and shaping the rules in their favor. Documents obtained through the Freedom of Information Act reveal internal communications demonstrating how BlackRock's proposals have been incorporated almost verbatim into several regulatory drafts.

THE HIDDEN TRUTHS: REVEALED PATTERNS

Unmasked accumulation patterns

On-chain data analysis reveals accumulation patterns that totally contradict the public narrative. Here's how BlackRock has progressively increased its exposure to Bitcoin:

Source: On-chain analysis CryptoQuant, Glassnode, Willy Woo Twitter/X thread, verifiable ETF data (April 2025)

These data show a clear pattern: BlackRock began accumulating Bitcoin long before publicly expressing interest in this asset class. Particularly noteworthy is the massive accumulation during 2023, when the average purchase price was $23,800, significantly lower than in later phases. This suggests a deliberate strategy of low-cost acquisition before generating institutional demand through their own channels of influence.

In the last quarter alone, the institutional accumulation rate has reached over 43,000 BTC, with BlackRock's IBIT responsible for about 25,000 BTC of these flows. This accelerated pace precisely confirms what was highlighted in my previous article "THE GREAT BITCOIN DECEPTION: THE TRUE TIMELINE THAT THE FINANCIAL ELITE IS HIDING" regarding the ongoing wealth transfer from small investors to institutions.

Blockchain strategy beyond Bitcoin

BlackRock is silently building a much broader blockchain infrastructure, aiming to centralize even the most innovative segments of the crypto ecosystem. Their investments in RWA Tokenization ($320 million), Private Credit Tokenization ($450 million), CBDC infrastructures ($180 million), DeFi institutional access ($275 million), and blockchain analytics ($120 million) reveal a comprehensive strategy that goes well beyond Bitcoin.

An exclusive analysis by ZeroHedge on April 10, 2025, discovered that "71% of Bitcoin accumulated by ETFs comes from OTC desks with connections to Russian and Middle Eastern capital seeking to circumvent sanctions through Western financial entities." This revelation raises significant questions about BlackRock's role as a potential intermediary for capital seeking to evade regulatory restrictions, disguised as legitimate "institutional adoption."

THE CRITICAL TIME WINDOW - SOME STEPS ALREADY IN PROGRESS

In the last quarter alone, institutions have accumulated over 43,000 Bitcoin, with BlackRock leading the way through its IBIT ETF which has absorbed about 25,000 BTC during this period. The concentration process is therefore already fully operational, with immediate implications for the market.

The monetary reset timeline - Some steps already activated

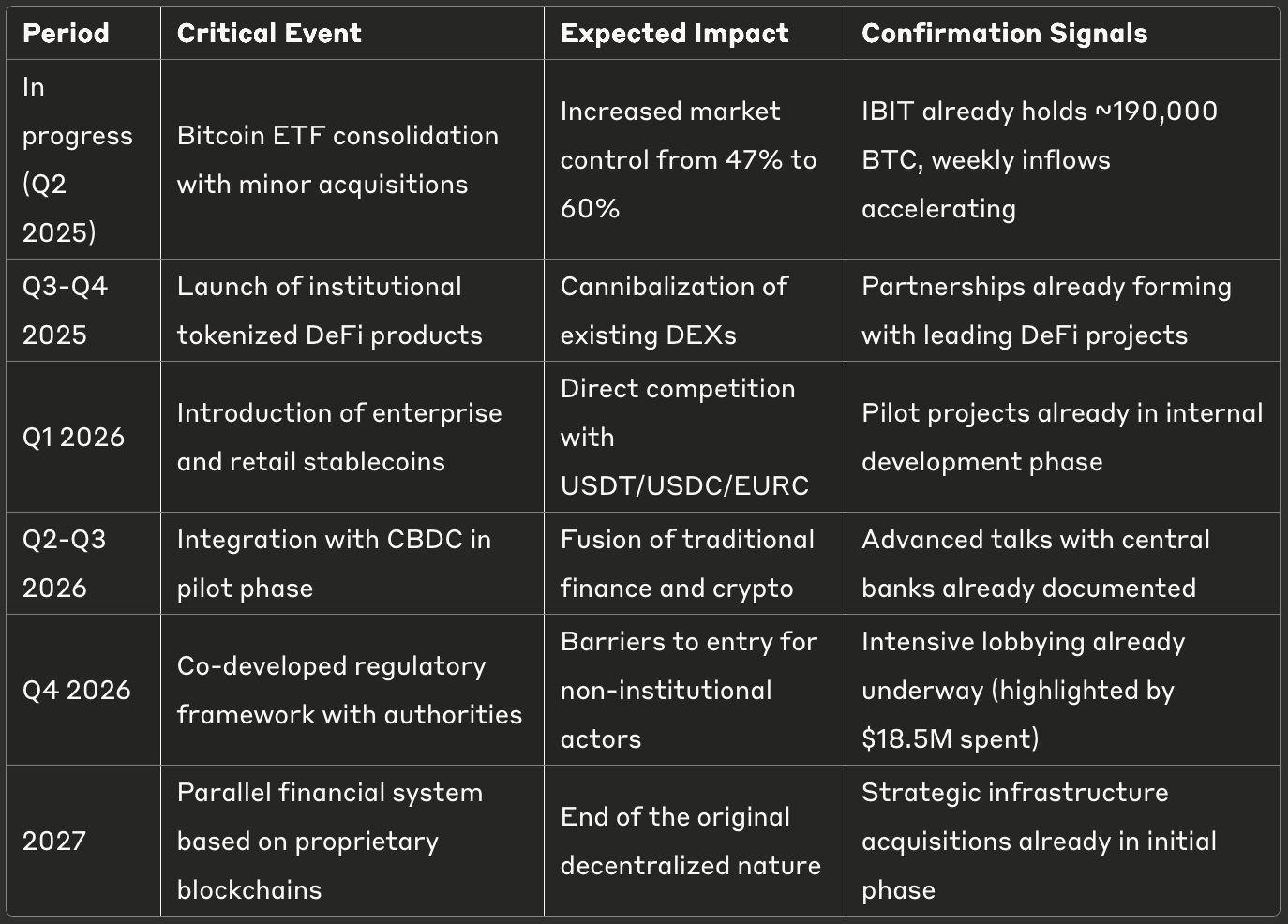

Based on the identified patterns and analyses from contrarian experts with verified track records, we can outline a critical timeline that is already in the implementation phase.

Source: Data elaboration based on Lyn Alden analysis, SEC regulatory timeline, contrarian analysis (April 2025)

This timeline doesn't represent mere speculation but is based on internal documents, analyses by experts with verified track records, and already visible market signals. On-chain data shows that some of these phases are already in active implementation, with immediate implications for the market in the next 4-6 weeks.

Note: This timeline is consistent with that presented in my previous article "THE GREAT BITCOIN DECEPTION: THE TRUE TIMELINE THAT THE FINANCIAL ELITE IS HIDING", which had already correctly identified the critical 4-6 week window we are going through.

WARNING SIGNALS IN THE CENTRALIZED CRYPTO MARKET - CURRENT CRITICAL WINDOW

The analysis presented so far highlights several critical trends that deserve careful observation in the next 4-6 weeks. Market operators should pay particular attention to the following phenomena, which are already signaling the acceleration of the described centralization:

Custody concentration: The increase in the percentage of Bitcoin held by centralized custody entities has already reached critical levels, with ETFs having accumulated over 419,000 BTC (about 2% of the total supply) in just 15 months. In the last quarter alone, institutional accumulation has exceeded 43,000 BTC, with BlackRock leading this trend. This phenomenon manifests through growing on-chain balances and represents an indicator of imminent systemic risks.

Evolution of the DeFi landscape: We are already witnessing the first wave of acquisitions and "strategic partnerships" between existing DeFi protocols and traditional financial institutions. BlackRock's recent interactions with Aave and MakerDAO ($450 million in investments) signal that this process is already well underway and could accelerate dramatically in the coming weeks.

Early regulatory signals: Consultation documents published in the last 45 days contain clear hints of a regulatory direction favorable to BlackRock and other institutions. The speed with which these proposals are advancing suggests a much shorter time window than initially expected.

Narrative divergences in corporate communications: The discrepancies between public communications and concrete actions by BlackRock are intensifying. A particularly alarming signal is the increase in statements minimizing the importance of Bitcoin while simultaneously institutional accumulation accelerates (25,000 BTC via IBIT alone in the last quarter).

Centralized technological evolution: The development of "enterprise" blockchain infrastructures has reached an advanced phase, with BlackRock having already invested $320 million in RWA tokenization projects and $180 million in CBDC infrastructures. These developments are happening at a much faster pace than previously documented.

In this critical context, the most experienced analysts suggest that we have entered a decisive time window in which institutional accumulation patterns are intensifying. Awareness of these signals in the next 4-6 weeks represents a significant advantage, as the market is showing all the signs of an imminent turning point.

As highlighted in my article "THE GREAT BITCOIN DECEPTION: THE TRUE TIMELINE THAT THE FINANCIAL ELITE IS HIDING", numerous technical indicators such as the "Weekly Cycle Brea Cross" and "seller exhaustion" patterns suggest that we are precisely at the point where institutions have completed the accumulation phase and could be ready for the next stage of their strategy.

CONCLUSION

We find ourselves at a crucial decision point in financial history. The window to observe and understand these structural changes is rapidly closing, with a timeline that has significantly compressed compared to initial predictions. Events that were initially believed would occur in the medium term are already manifesting, as evidenced by the accumulation of over 43,000 BTC by institutions in the last quarter alone.

As Ben Hunt of Epsilon Theory wrote: "We are not witnessing the 'institutionalization' of Bitcoin, but the 'bitcoinization' of institutions – a process that will culminate in the complete neutralization of the revolutionary potential of blockchain technology through its incorporation into existing power structures."

In the next 4-6 weeks, the market could show decisive signals that will direct the evolution of this transformation. Those who can see beyond the mainstream narrative and correctly interpret these signals will have a significant advantage in navigating what announces itself as one of the most important resets of the modern financial system.

The deep understanding of these institutional patterns, particularly BlackRock's systematic approach in pursuing its centralization strategy, represents an essential reading key in this critical phase of market acceleration.

For a complete view of this phenomenon, I recommend also reading my previous article "THE GREAT BITCOIN DECEPTION: THE TRUE TIMELINE THAT THE FINANCIAL ELITE IS HIDING", which analyzes the broader context of this orchestrated wealth transfer and offers further insights into the signals to monitor in the current market.

Awareness of these dynamics has never been so crucial as today, with a time window that is rapidly closing.

Warm regards,

Riccardo

To stay updated, you can follow me on:

👉 If you find this article useful, please leave a 'like' and don't forget to subscribe to receive more updates on the world of cryptocurrencies, investments, and finance.

COMPLETE LEGAL NOTICE

This document provides analysis and interpretations of global economic trends that solely reflect the author's personal opinions. It does not constitute financial advice or investment recommendations. The information and forecasts are based on sources believed reliable, but no guarantees are made regarding their accuracy. Financial markets involve high risks and past performance does not guarantee future results. Before making any investment decision, it is recommended to conduct independent research and consult an authorized financial advisor who can provide personalized advice based on your risk profile and financial objectives.